Authorised Economic Operator (AEO) Scheme

“Authorized Economic Operator” (AEO) means a company validated and authorized by the respective Customs in accordance to their business with an internationally recognized security standard. This programme promotes an AEO certified company as a ‘Secure’ and ‘Reliable’ trade partner. In light of the international developments, as well as given the focus of the Government of India on “Ease of Doing Business”, CBEC has developed comprehensive unified trade facilitation revised AEO Programme to provide businesses with an internationally recognized quality mark which will indicate their secure role in the international supply chain and that their Customs procedures are efficient. An entity with an AEO status can, therefore, be considered a ‘Secure’ and ‘Reliable’ trading partner. This scheme is available to only those units who are related to Customs Clearance Work and have a clean track record. The unit (Importer/Exporter/Customs Broker/Others) is given facilitation in resolving their problems on FAST TRACK, i.e. within the prescribed time period and without taking the bank Guarantee, etc.

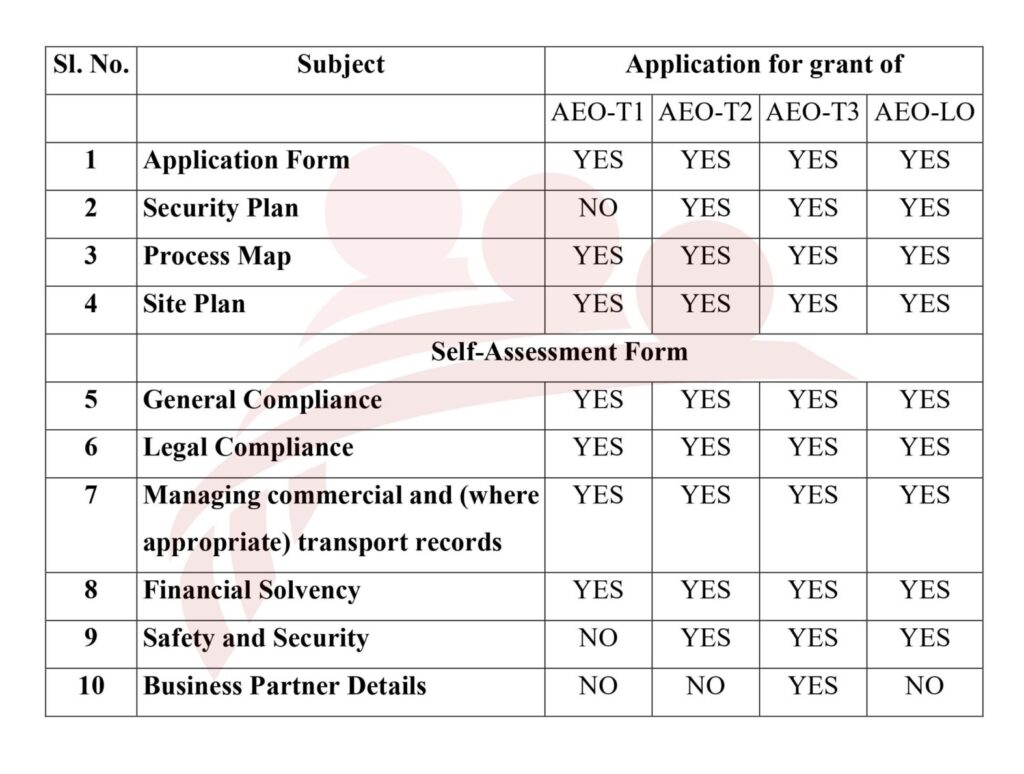

Three-tier AEO Scheme: For the importers and the exporters, there are three tiers of certification (i.e. AEO-T1, AEO-T2 and AEO-T3). For the economic operators other than importers and the exporters, the new programme offers only one tier of certification AEO-LO. All existing ACP clients have the opportunity to apply within 90 days for a grant of AEO certificate and shall continue to avail the benefits of AEO-T1 till the decision is taken on their application. They can directly apply for AEO-T2 status. There is no visit for physical verification by the AEO team for AEO-Tire-1 applicants.

Online Inquiry

Advantages / Benefits:

- Status – Use of AEO Logo – Recognition by Govt. Agencies

- ID Cards to Authorised Personnel for hassle free entry to Custom Houses, Ports, CFSs and ICDs.

- Direct Port Deliveries of imports (DPD) – Huge cut in time of delivery

- Direct Port Entry of factory stuffed containers for exports (DPE)

- Shorter cargo release time

- Separate space earmarked in Custodian’s premises

- 50% of normal Bank Guarantee, if required

- Wherever feasible, they will get separate space earmarked in Custodian’s premises

- Investigations, if any, in respect of Customs, Central Excise and Service Tax cases would be completed, as far as possible, in six to nine months

- Faster Adjudications of pending cases

- Not subjected to regular transactional PCA, instead of that onsite PCA will be conducted once in two years only

- E-mail communication regarding arrival/departure of the vessels carrying their consignments

- 24/7 clearances and without Merchant Overtime Fee

- All the Benefits offered in AEO-T1 and

- Faster Customs clearance and simplified Customs procedure

- Container seal verification/scrutiny of documents would be waived

- Facility of deferred payment of duty will be provided, from a date to be notified

- Faster refunds/rebate/drawback (within 72 hrs EGM Submission), SVB, Bill of Entry/SB Assessment

- Facility of self-sealing of export goods

- 25% of normal Bank Guarantee, if required

- Facility to paste MRP stickers in assessee’s premises

- No regular Audit but only onsite PCA – once in three years only

- On-site inspection/examination per request

- Access to import/export data through ICEGATE

- Facility of submitting paperless declaration with no supporting documents in physical form

- “Client Relationship Manager” (CRM) at the level of Deputy / Assistant Commissioner as a single point of interaction with them, who will render all assistance to the assessee’s in getting issues resolved

- Faster completion of Special Valuation Branch (‘SVB’) proceedings in case of related party imports and monitoring of such cases for time bound disposal in terms of new guidelines

- Trade facilitation by a foreign Customs Administration with whom India enters into a Mutual Recognition Agreement

- The refund/Rebate of Customs/Central Excise duty and Service Tax would be granted within 45 days of the submission of complete documents

- They will get trade facilitation by a foreign Customs administration with whom India enters into a Mutual Recognition Agreement/Arrangement

- All the Benefits offered in AEO-T2 and

- Highest level of facilitation

- Normally no Scanning of containers

- Self certified documents suffice, no insist upon original documents

- No Bank Guarantee in normal case

- On request, will be provided on-site inspection/examination

- Faster refunds/rebate within 30 days

- Customs Brokers:

- Waiver of Bank Guarantee to be furnished under regulation 8 of the CBLR, 2013.

- Extended validity (till validity of AEO status) of licenses granted under regulation 9 of the CBLR, 2013.

- Waiver from fee for renewal of license under sub clause (2) of regulation 11 of CBLR, 2013.

- Facility of Execution of running bond

- Exemption from permission on case to case basis in case of transit of goods.

- In case of international transshipped cargo (Foreign to Foreign), for the pre-sorted containers wherein Cargo does not require segregation, ramp to ramp transfer of cargo can be elected without Customs escorts.

- Logistic Service Providers:

- Waiver of bank Guarantee in case of transshipment of goods under Goods imported (Condition of Transshipment) Regulations, 1995

- Facility of Execution of running bond.

- Exemption from permission on case to case basis in case of transit of goods

- Custodians or Terminal Operators:

- Waiver of bank Guarantee under Handling of cargo in Customs Area Regulations 2009

- Extension of approval for custodians under regulation 10(2) of the ‘Handling of cargo in Customs Area Regulation 2009’ for period of 10 years

- Warehouse Operators:

- Faster approval for new warehouses within 7 days of submission of complete documents

- Waiver of antecedent verification envisaged for grant of license for warehouse under circular 26/2016

- Waiver of solvency certificate requirement under circular 24/2016

- Waiver of security for obtaining extension in warehousing period under circular 21/2016

- Waiver of security required for warehousing of sensitive goods under circular 21/2016

Disadvantage

There is no disadvantage for AEO unit except that the unit has to face the ‘On-Site Post Clearance Audit’ once in two years for AEO-T1 and once in three years for AEO-T2. Even if any irregularity is noticed, there shall be no penalty.

Who Can Apply

Any person who is related to Customs and fulfilling the criteria stated below can apply for AEO registration. Following types of unit can apply for registration i.e.:-Importer ( Actual User/Manufacture/Trader), Exporter, EOU, Logistics viz Customs Broker/CHA, ICD/CFS, Freight Forwarder, Warehouse, Transporter, Steamer Agent/Shipping Company, Logistic and Multi-Model Company and Supply Chain Units.

Eligibility

(i) Minimum 25 documents (Bill of Entry + Shipping Bills) should have been filed in the preceding financial year.

(ii) No case involving serious offense relating to Customs, Excise, or Service Tax should be pending. This criteria can be relaxed for new units and for those involved in minor cases.

Legal Compliance

Criteria for making application:-

- The Applicant must be established in India

- No SCN issued during last 3 financial years

- No case of prosecution launched or contemplated

- If the duty/drawback demanded in SCN to Total Duty paid/ DBK claimed is more than 10%, status shall be reviewed.

- System to identify and disclose any irregularities or error to customs

- Maintaining Standard Accounting Practices

- Trained Manpower

- Security of the computer system

- Financially solvent during the last 3 financial years

- Safety and security of the business premises

- Management of the flow of goods

- Procedures in place for the handling of licenses and authorizations connected to export / import.

Application Form

The Application for AEO is required to be made to D.G. Performance Management, I.P. Estate, New Delhi 110002 containing 10 Annexures given below:-

Validity of AEO Certificate

The validity of the AEO certificate shall be three years for AEO-T1 and AEO-T2, and five years for AEO-T3 and AEO-LO.

Basic Document Required

The List of the documents required to prepare the application for AEO and which are required to be annexed with application are:-

- Copy of the company incorporation/partnership/etc

- Copy of IE Code

- List of Office/site/warehouses

- Copy of PAN card

- Copy of Service Tax, C. Excise Registration, if any

- Summary of documents filed during last 3 years (port/ airport wise)

- Balance Sheet for last 3 years

- Solvency Certificate by Auditor

- Site Plan/Google Map/Location

- Business Profile

- Self-Declaration

- SOPs (Standard Operating Procedure )

- KYC Documents

- Contract Copy with Business partners

- Details of partners and address of Chartered Account

- Flow Chart

- List of Branch Offices etc

- List of clients

Time Schedule

The normal time period is 90 days. First, the deficiency memo is issued after the scrutiny of the AEO application within 30 days. Thereafter the AEO status is granted within 60 days after removal of deficiencies. There is no visit or physical verification by the AEO team for AEO-Tire-I applicants.

‘Scope of Work’ of Whitefield Exim (Advocates & Consultants)

Preparation of Application & 10 Annexures for AEO Certification is highly technical in nature. In

addition to the advisory consultancy on the subject, Whitefield Exim will also do all type of documentation as given below:

- Visit to Applicant Office :- A qualified officer from Whitefield Exim team will visit to your office, if required for preparation of various documents from time to time. It requires 7 to 10 days to prepare the application.

- Documentation :- Proper documentation to avoid rejection/query from AEO Registration Office.

- Compliance :- Whitefield Exim will draft & submit further submission/clarification to any query/objection raised by AEO Registration Officer.

- Follow up :- Whitefield Exim will follow up the matter with concerned departments till AEO Certification is granted.

- Audit/Inspection :- Whitefield Exim can also provide consultancy at the time of ‘On Site Audit/Inspection” by AEO Team, if required.